Glossary for the Year-End Transition 18/19: BEA, rvBEA, GML57 & ERiC

At the turn of the year 2018/2019, several procedures in communication with authorities are being reconfigured. This also includes electronic transmission from the SAP HCM system to the authorities. We have already informed our AMS customers about these changes in an information letter. Below, you will find further explanations and details.

BEA: Transmission of Certificates to the Federal Employment Agency

The acronym ‘BEA’ stands for ‘Bescheinigungen elektronisch annehmen’ (Electronically Accept Certificates). This procedure allows for the electronic transmission of data or certificates to the Federal Employment Agency. As a result, the certification of wages using forms becomes obsolete, and wages can be reported directly from SAP. The following certificates can currently be electronically accepted by the Federal Employment Agency (BA):

- Employment certificates

- Employment certificates for the purposes of national and international law

- Supplementary income certificates

For more information, you can refer to the following SAP note: SAP Note

rvBEA: Electronically Requesting Certificates from Pension Insurance Providers

‘rvBEA’ defines a new communication standard between employers and pension insurance providers through the data center of the German Pension Insurance (DSRV). The GML57 sub-procedure is the first valid procedure.

Through this procedure, pension insurance is enabled to electronically request the following data from employers and receive them:

- Separate reports with reporting reason 57 (GML57)

- Initial incomes

- Income changes

The exchange procedure is based on an XML schema.

Electronic Request for Separate Reports – GML57

Participation as an employer is voluntary. However, the integration of the corresponding modules into payroll software is mandatory from January 1, 2019. If you choose to participate as an employer, you commit to retrieving data from the communication server of the pension insurance once a week. Prior registration of the employer for the GML57 procedure is required. When the pension insurance provider requests a separate report for an employee, the registered employer is informed through the electronic reporting process.

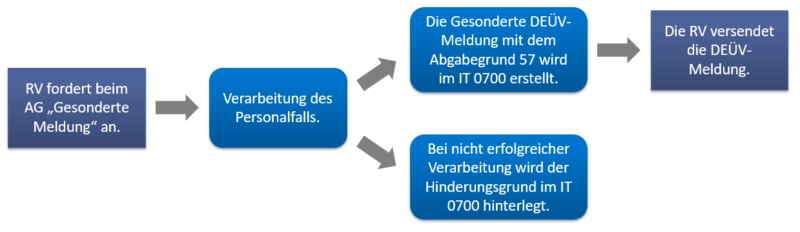

In the initial process, a record of Infotype 0700 or subtype “Request for Separate Report” (DXAR) is created in the master data of the affected individual. If an error occurs during the retrieval of the request for the separate report, subtype DXAR with the indication of a blocking reason is created. The rejected data must be reviewed and corrected by the employer if necessary. If no correction is possible, the blocking reason must be reported to the pension insurance provider.

With the next run of the “Create DEÜV Reports” report (RPCD3VD0), the DXAR subtype record is read, and a separate report DEÜV report with submission reason 57 is created.

Once the data has been successfully processed, the pension insurance provider sends a certificate to the affected employee.

Further information can also be found in the SAP Note: SAP Note

ERiC: ELSTER Rich Client – Transition of the entire communication with tax authorities

The open interface to tax authorities for payroll tax returns is terminated as of January 1, 2019. There is a transition period for SAP systems until June 30, 2019. During this period, the interface will be “frozen” by the tax authorities, providing both tax authorities and SAP customers with more time for the transition. SAP plans to transition the transmission for the entire communication with tax authorities (LStA, LStB, and ELStAM).

According to current information, some of the ERiC components previously published by tax authorities are not supported by all operating systems. Therefore, it is advisable to check early whether your middleware’s operating system is supported. You can find a list of all supported operating systems in the following note: SAP Note